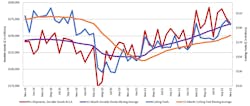

Machine shops and other U.S. manufacturers began to decelerate their activities during the last quarter of 2022, as indicated by the -3.1% drop in cutting-tool consumption from October to November. The $194.4 million total for November still indicated a 20.8% improvement over the November 2021 consumption total, and boosted year-to-date cutting-tool consumption to $2.0 billion, a 10.4% increase over the January-November 2021 total.

The CTMR differs from the monthly U.S. Manufacturing Technology reportv issued by AMT, which is a forward-indicator of manufacturing activity based on machine shops’ investments in capital equipment. Over recent months, the USMTO index has been declining as a result of supply-chain disruptions, rising interest rates, and other factors slowing future orders for manufactured parts.

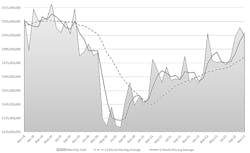

“The GDP measures durable goods, non-durable goods, and services, so is it possible that the forecasted recession will largely avoid durable goods,” observed Costikyan Jarvis, president of Jarvis Cutting Tools.

“The 12-month CTMR average is only 90% of pre-pandemic levels,” Jarvis continued. “Commercial aerospace production is still recovering, and the automotive market, after only selling 13.7 million units, has the possibility to stay flat.”